Executive summary

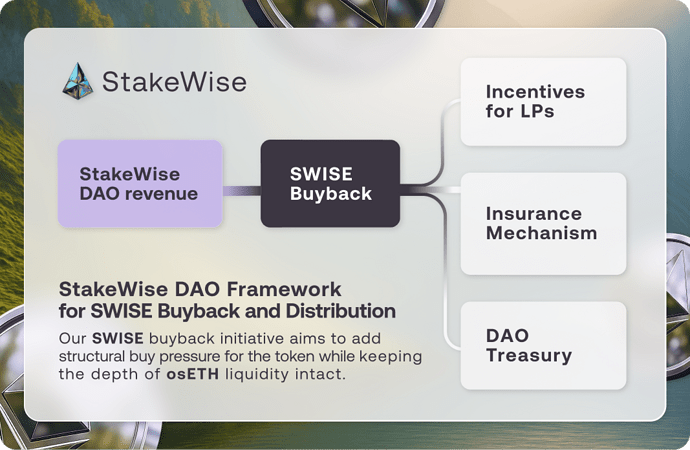

In this proposal, we outline a plan for establishing periodic SWISE buybacks using the DAO Treasury funds, in order to offer structural support to the token.

The goal is to direct up to 100% of the protocol revenue towards buybacks, to be used for liquidity incentives or other purposes.

We foresee up to 35 ETH worth of SWISE purchasing every month, with the exact figure depending on the DAO fee generation level.

Motivation

It was only 6 months ago that the StakeWise DAO was using SWISE emissions to incentivize token liquidity.

A surge in DAO revenue has allowed us to reduce such emissions by 90% since April, distributing osETH tokens earned from DAO fees as rewards to liquidity providers in the various StakeWise pools.

We now believe that the DAO can take the next step and further improve the way we reward LPs, helping the SWISE token in the process.

With the current budget of ca 25 osETH per month (20 osETH, and 1,060,000 SWISE), StakeWise has been able to maintain deep liquidity for osETH on both mainnet and Arbitrum. Rewards are distributed as a mix of osETH and SWISE, giving LPs a combination of ETH and StakeWise upside.

We find that the time is now right to switch back to exclusively SWISE-denominated incentives, which would be sourced from the market via periodic buybacks.

Instead of distributing 20 osETH and emitting 1M SWISE per month, we suggest deploying up to 35 osETH per month towards SWISE buybacks, to be carefully distributed towards incentives, as well as used for other purposes like burning and insurance (to be discussed at a later stage).

This switch would create structural demand for SWISE worth up to $2M per year at current prices, which is significant against our $11M mcap. It would also allow LPs to benefit from the upside created by future tokenomics changes, as well as new product launches. In short, we view this is a win-win for both StakeWise and its liquidity providers.

Considerations

There are several important factors that must be taken into account.

The most obvious is the behaviour of LPs in response to a switch back to exclusively SWISE-denominated incentives. It is possible that either our liquidity levels will decline, or that distributed SWISE will be dumped on the market, or both, in response to the switch.

We believe that the risk of this is moderate, and realistically can only be mitigated by further improving the attractiveness of the token and our protocol in the eyes of the market.

Hence, we believe that the DAO must accept these risks, but stay ready to reverse course if the response is overly negative. We welcome comments and questions from osETH and SWISE LPs below to help illuminate the discussion.

Another consideration is the extent of buybacks. Current DAO revenue generation level is ca 20 osETH per month, down from the 35 osETH per month at its peak in late July (i.e. before the rate volatility on Aave has begun, and a significant number of Boost positions were unwound).

The minimum proposed monthly buyback is 20 osETH, which is what is currently being distributed to LPs monthly, and corresponds to 100% of DAO’s earnings. This level would allow the DAO to maintain the reserves of osETH in the Treasury intact (ca 370 osETH), and keep the value of LP incentives unchanged.

The maximum proposed buyback is 100% of DAO’s monthly earnings, meaning that if (when) DAO’s earnings start climbing again (driven by improvements to Boost and continued work to bring new stake into the protocol), more osETH would be directed towards buybacks. After deducting for 20 osETH each month (the necessary amount to be spent on incentives), the remainder of purchased SWISE could be directed towards burning or other purposes (e.g. insurance).

Finally, more liquidity for SWISE is required for buybacks and tokenomics changes to have an effect on people’s perception of SWISE. In connection to this, we have launched a separate proposal to deploy a new SWISE-osETH pool, with the goal of switching incentives to it away from the legacy SWISE-ETH pool. You can check out the proposal and leave your thoughts in the relevant thread.

Specification

Should this proposal pass, the team will submit periodic requests for funding as it currently does for liquidity, using the funds received from the DAO to execute SWISE buybacks via CowSwap, and distributing repurchased SWISE to LPs via the usual mechanisms.

Discussion

We are not initiating the Snapshot vote for this proposal straight away, and instead are looking for community feedback first before submitting a formal proposal. We expect the discussion stage to last 14 days.

Please leave your comments, questions, and feedback in this thread!