SLC Request - Incentives for weeks 22-25 (2025)

This is a proposal to allocate SWISE from the StakeWise DAO Community Treasury to the StakeWise Liquidity Committee (SLC) to be used solely to incentivise the liquidity ecosystems of all StakeWise tokens. Please take the time to review the report from the previous month (link) and the proposed budget for the upcoming month before voting. The vote is live and can be found (link).

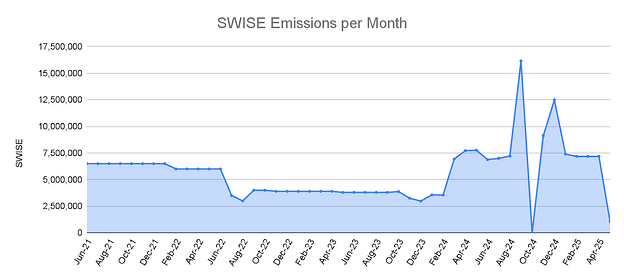

For a high-level overview of how StakeWise DAO’s SWISE emissions have evolved over the previous months, see the following chart:

Also note that reports have moved to a week-based request schedule and accounting to better align with the practical side of distributing incentives and making budget requests.

Report on the incentive allocation for weeks 18-21 (2025)

| Inflows (Budget) | Outflows | |

|---|---|---|

| SWISE liquidity pool | 215,000 SWISE & 3.56 osETH | 180,000 SWISE & 3.72 osETH |

| osETH liquidity pools (Mainnet) | 780,000 SWISE & 14.76 osETH | 809,000 SWISE & 15.7785 osETH |

| osETH liquidity pools (Arbitrum) | 30,000 SWISE & 1.67 osETH | 72,000 SWISE & 1.868 osETH |

| osGNO Liquidity pools | 0 SWISE | 0 SWISE & 0 osETH |

| Total | 1,025,000 SWISE & 20 osETH | 1,061,000 SWISE & 21.3665 osETH |

osETH liquidity pools (Mainnet)

Liquidity in the osETH-ETH pools on Balancer has gone down a bit in ETH terms - from 19.3K ETH to 18.7K ETH worth of tokens, or $47.7M. Liquidity is currently split between the original osETH-ETH pool and the new, Boosted osETH-ETH pool, which is peculiar given the old pool is no longer receiving incentives, while LPs in the new pool earn a market-leading >5.5% APY majority denominated in ETH. The weight composition of the pools is notably (60%+) skewed in favour of osETH, and requires rebalancing. The committee is considering market intervention via the redemption mechanism to bring liquidity back into balance.

The osETH-rETH pool on Curve grew ca 20% month-on-month, with liquidity of around $17 million now based on ca 6.5K ETH worth of tokens, vs 5.5K the month prior. The pool is now much better balanced than before, resembling the original weights (~50/50). We will continue monitoring the composition of the pool.

osETH liquidity pools (Arbitrum)

The combined liquidity levels for osETH pools on Arbitrum now sit at around $0.9 million vs ~$0.45M a month ago, driven by the increase in ETH prices and deposits into the new, Boosted osETH-ETH pool on Balancer.

The allocated SWISE & osETH incentives provide an APY of ~10% for LPs, having normalized from >15% through a slight reduction in incentives and inflows into the pool. The team will continue to monitor the impact of incentives on liquidity.

osGNO liquidity pools

The osGNO-GNO liquidity pool on Balancer sits at around $2.4M in TVL, double vs a month ago, having grown in terms of GNO token balance and in dollar. This pool is not currently receiving SWISE incentives, being incentivized instead by the Gnosis ecosystem participants. The APY for LPs has increased from 5% to 11%, which is a very positive lead indicator on osGNO depth given sensitivity of capital flows in the Gnosis Ecosystem to available yield opportunities. Increased depth is very welcome in light of imminent onboarding of osGNO into Aave on Gnosis Chain. The team will continue monitoring the situation and will commence liquidity incentivization if needed.

SWISE liquidity pool

There are no major inflows or outflows to report.

Proposed budget for the next 4 weeks

| Week 22-25 (2025) | Inflows (Budget) |

|---|---|

| SWISE liquidity pool | 215,000 SWISE & 3.56 osETH |

| osETH liquidity pools (Mainnet) | 780,000 SWISE & 14.76 osETH |

| osETH liquidity pools (Arbitrum) | 30,000 SWISE & 1.67 osETH |

| osGNO Liquidity pools | 0 SWISE |

| SLC refund for spent tokens | 36,000 SWISE & 1.3665 osETH |

| Total | 1,061,000 SWISE & 21.3665 osETH |

osGNO liquidity pools

With a substantial reserve built up from the previous months, and the high level of incentives in the pool as of today, we are not requesting any tokens for the osGNO-GNO pool for the next 4 weeks.

SWISE liquidity pool

The aim is to maintain current liquidity, requiring 215K SWISE & 3.56 osETH per month at current market prices. This represents a 25/75 mix of SWISE/osETH incentives, consistent with the DAO-approved initiative to start using osETH for liquidity incentivization, targeting ca 10% APY.

osETH liquidity pools Mainnet

The current liquidity depth is strong vs the overall TVL of StakeWise V3 and should be maintained. The expected cost for doing so is around 780,000 SWISE & 14.76 osETH per month, consistent with the ability to reduce expenditure thanks to moving to a Boosted pool, and replacing 75% of the incentives with osETH.

osETH liquidity pools Arbitrum

After further analysis vs last month, the SLC believes that the liquidity depth of osETH pools on Arbitrum is optimal given its utilization in the ecosystem, and therefore does not require improvement. An allocation of 30,000 SWISE & 1.67 osETH per month is being requested, consistent with the ability to reduce spend thanks to moving to a Boosted Balancer pool, and replacing 75% of SWISE incentives with osETH.

SLC refund for spent SWISE

Due to the trialing of the new incentives mix, ~7% more osETH and ~4% more SWISE than originally budgeted has been spent in the weeks 18-21 to gauge the effect of slightly higher incentives and a different token mix on liquidity. In the new month, the proposed budget will be strongly adhered to. The refund of 1.3665 osETH and 36,000 SWISE is requested for the excess spending, fronted by the team.