Summary

The core team is frequently in discussions with wallets and other potential partners to integrate StakeWise’s staking service within their platforms. The topic of a referral program is commonplace, especially with other staking providers offering rewards for these types of integration. This proposal will explore a referral program of our own in order to facilitate further StakeWise integrations within the space.

Motivation

The aim is to create strategic partnerships which drive TVL growth and create increased value to SWISE holders.

The flywheel is well defined: TVL drives integrations and exposure, which drives further TVL.

Specification

The proposed referral program will reward partners through the following terms:

Pay up to 1% of the $ value of ETH staked via referrer, paid in SWISE. SWISE rewards are calculated monthly based on the ETH/USD and SWISE/USD 30 days time-weighted average price (TWAP). The minimum reward amount is 5 SWISE and the maximum reward amount is 250 SWISE per 1 ETH staked. Each referrer is subject to a 1,000,000 SWISE cap. Once this cap is reached, SWISE rewards will cease and a new agreement will need to be entered. StakeWise maintains the right to cancel the program at any time should the pre-agreed conditions change.

Only whitelisted protocols will be able to join the program with initial agreements curated by the core StakeWise team. The DAO will have the final say however, with a vote required to pay out the referral rewards on a monthly basis (further details below). Each partnership will have pre-agreed conditions which need to be met in order for the program to continue.

Example reward payments

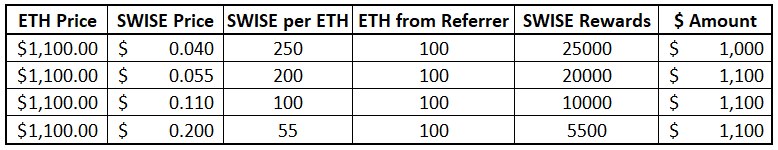

To highlight the relationship between all the variables, the below table assumes 100 ETH is referred to StakeWise through a partner in 1 month:

The $ value of referrals depends linearly on ETH price, with the ETH/SWISE price determining the amount of SWISE per reward period. As SWISE increases in price with respect to ETH, the $ cost of the referrals stays the same, but the amount of SWISE paid out decreases. And vice versa for when SWISE underperforms vs ETH.

The referral program is designed to scale alongside our protocol. As the price of ETH rises, the cost of the referral program increases, but our protocol revenues also increase. As protocol TVL increases, the fundamental value of SWISE (theoretically) increases with respect to ETH, which will reduce the amount of SWISE emitted by the program.

The max SWISE per ETH set to 250 protects against StakeWise giving away excess SWISE should SWISE underperform vs ETH. We are very near this 250 limit at current prices. As the positive flywheel effect comes into play, we expect the cost of this program to decrease over time.

Currently, a partner would earn 1M SWISE in referrals if they provide ~4k ETH TVL.

Deposit Tracking

ETH staked through partners can be tracked in multiple ways:

- Mike has developed a fantastic plug-and-play widget, allowing protocols to easily integrate StakeWise liquid staking within their Ul. This widget handles the tracking of deposits for each protocol that has it implemented.

- Protocols that integrate directly with our smart contracts have the ability to pass a unique address when calling ‘Stake_with_referrer’.

- Protocols can direct users to our DApp via a referral URL, again referencing a unique address as provided by the protocol. The URL takes the form of: StakeWise | Stake.

A public Google Sheet will be created to track the referrals from each specific address/partner.

Method of Distribution

On the 1st of each month, the SWISE referral rewards for the previous month will be calculated for each partner. A snapshot will then be submitted to transfer the total monthly SWISE rewards from the community treasury to the respective partners. The DAO will always need to approve adding new names to the referral program.

Risks/Considerations

Deposit Cycling - it is very difficult to identify users who cycle their deposits: stake ETH → receive the referral rewards → un-stake via the secondary markets → re-staking and receiving further rewards. This kind of activity will not only abuse the referral scheme to earn excess SWISE rewards, but it can also have a negative impact on sETH2 peg stability.

The best way to solve this problem is to ensure the entities who receive the referral rewards are different from those whose ETH contributes towards the referral. There is always a risk that the entity receiving the rewards colludes with a third party to exploit the system however, and this is precisely why this program will be kept closely safeguarded. Only trusted entities will be allowed to enter the program. StakeWise will always retain the right to cancel the program for any partner, or altogether, should there be any concerns about it being taken advantage of.

Initial Program Partners

The team has preliminary agreements with three entities for the program should the DAO agree to proceed:

- MyEtherWallet (MEW) - full rewards program for the native staking integration of StakeWise within their wallet.

- Babylon Finance - full rewards program for whitelisting StakeWise staking as an eligible strategy within Gardens.

- Zengo - 25% rewards program to add StakeWise as a recommended DApp within their DApp browser. To be upgraded to the full program following a full native staking integration.

Given these integrations are already in place, we propose the referral rewards are backdated to when the integrations went live, should the DAO be happy to proceed with the referral program.

POLL

We would love to hear your feedback on this proposal and indicate your views via the below poll. A snapshot vote will be created in the coming days to formalise this proposal on-chain.

Should StakeWise implement the referral program for partner projects?

- Yes, in its current form

- Yes, but with adjusted terms

- No, a referral program is not necessary