This is a proposal to allocate SWISE from the StakeWise DAO Community Treasury to the StakeWise Liquidity Committee (SLC) to be used solely to incentivise the liquidity ecosystems of all StakeWise tokens. Please take the time to review the report from the previous month (link) and the proposed budget for the upcoming month before voting. The vote is live and can be found (link).

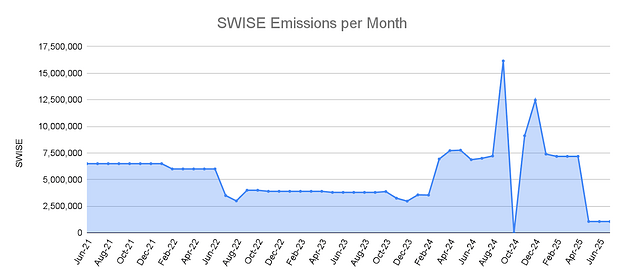

For a high-level overview of how StakeWise DAO’s SWISE emissions have evolved over the previous months, see the following chart:

Report on the incentive allocation for weeks 26-29 (2025)

| Inflows (Budget) | Outflows | |

|---|---|---|

| SWISE liquidity pool | 215,000 SWISE & 3.56 osETH | 215,000 SWISE & 3.56 osETH |

| osETH liquidity pools (Mainnet) | 780,000 SWISE & 14.76 osETH | 780,000 SWISE & 14.76 osETH |

| osETH liquidity pools (Arbitrum) | 30,000 SWISE & 1.67 osETH | 30,000 SWISE & 1.678 osETH |

| osGNO Liquidity pools | 0 SWISE | 0 SWISE & 0 osETH |

| Total | 1,025,000 SWISE & 20 osETH | 1,025,000 SWISE & 20 osETH |

osETH liquidity pools (Mainnet)

Liquidity in the osETH-ETH pools on Balancer has decreased in ETH terms - from 26.7K ETH to 24K ETH worth of tokens, or $87.8M. Liquidity is still split between the original osETH-ETH pool and the new, Boosted osETH-ETH poo - again, we note that this is unlikely to be sustainable given the old pool has stopped receiving incentives, and capital is likely to eventually migrate away from it. The weight composition of the pools has returned to a balanced 50:50 situation, driven by market forces (no intervention was made).

Liquidity in the osETH-rETH pool on Curve remained roughly flat at around $22.7 million based on ca 6.3K ETH worth of tokens, unchanged from last month. The pool remains well-balanced (~50/50). We will continue monitoring the composition of the pool.

osETH liquidity pools (Arbitrum)

The combined liquidity levels for osETH pools on Arbitrum now sit at around $1.18 million vs ~$0.55M a month ago, driven by inflows and ETH price increase. APY remains very attractive even after additional inflows, at ~10%.

osGNO liquidity pools

The osGNO-GNO liquidity pool on Balancer sits at around $2.75M in TVL, up on the month as a result of GNO price run. This pool is not currently receiving SWISE incentives, being incentivized instead by the Gnosis ecosystem participants. The APY for LPs has gone down a bit to 13%.

SWISE liquidity pool

There are no major inflows or outflows to report.

Proposed budget for the next 4 weeks

| Week 30-33 (2025) | Inflows (Budget) |

|---|---|

| SWISE liquidity pool | 215,000 SWISE & 3.56 osETH |

| osETH liquidity pools (Mainnet) | 780,000 SWISE & 14.76 osETH |

| osETH liquidity pools (Arbitrum) | 30,000 SWISE & 1.67 osETH |

| osGNO Liquidity pools | 0 SWISE |

| Total | 1,025,000 SWISE & 20 osETH |

osGNO liquidity pools

With a substantial reserve built up from the previous months, and the high level of incentives in the pool as of today, we are not requesting any tokens for the osGNO-GNO pool for the next 4 weeks.

SWISE liquidity pool

The aim is to maintain current liquidity, requiring 215K SWISE & 3.56 osETH per month at current market prices. This represents a 25/75 mix of SWISE/osETH incentives, consistent with the DAO-approved initiative to start using osETH for liquidity incentivization, targeting ca 10% APY.

osETH liquidity pools Mainnet

The current liquidity depth is strong vs the overall TVL of StakeWise V3 and should be maintained. The expected cost for doing so is around 780,000 SWISE & 14.76 osETH per month, consistent with the ability to reduce expenditure thanks to moving to a Boosted pool, and replacing 75% of the incentives with osETH.

osETH liquidity pools Arbitrum

After further analysis vs last month, the SLC believes that the liquidity depth of osETH pools on Arbitrum is optimal given its utilization in the ecosystem, and therefore does not require improvement. An allocation of 30,000 SWISE & 1.67 osETH per month is being requested, consistent with the ability to reduce spend thanks to moving to a Boosted Balancer pool, and replacing 75% of SWISE incentives with osETH.