SLC Request - Incentives for weeks 39-42 (2025)

This is a proposal to allocate SWISE and osETH from the StakeWise DAO Community Treasury to the StakeWise Liquidity Committee (SLC) to be used solely to incentivise the liquidity ecosystems of all StakeWise tokens. Please take the time to review the report from the previous month (link) and the proposed budget for the upcoming month before voting. The vote is live and can be found (link).

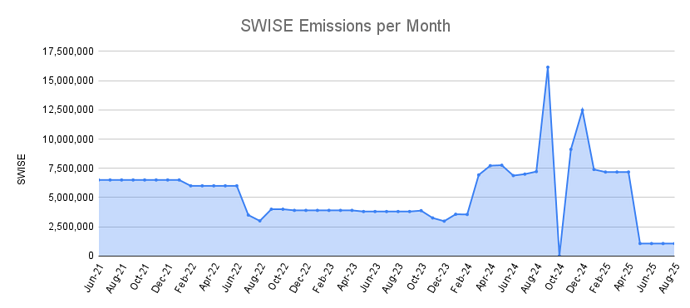

For a high-level overview of how StakeWise DAO’s SWISE emissions have evolved over the previous months, see the following chart:

Report on the incentive allocation for weeks 30-33 (2025)

| Inflows (Budget) | Outflows | |

|---|---|---|

| SWISE liquidity pool | 215,000 SWISE & 3.56 osETH | 215,000 SWISE & 3.56 osETH |

| osETH liquidity pools (Mainnet) | 780,000 SWISE & 14.76 osETH | 780,000 SWISE & 14.76 osETH |

| osETH liquidity pools (Arbitrum) | 30,000 SWISE & 1.67 osETH | 30,000 SWISE & 1.678 osETH |

| osGNO Liquidity pools | 0 SWISE | 0 SWISE & 0 osETH |

| Total | 1,025,000 SWISE & 20 osETH | 1,025,000 SWISE & 20 osETH |

Temporary funding in the amount of 11.379 osETH and 550,000 SWISE will have been provided to the SLC from the team multisig by the time this vote concludes due to delay in kickstarting a new vote.

osETH liquidity pools (Mainnet)

Liquidity in the osETH-ETH pools on Balancer has decreased slightly in ETH terms - from 24K ETH to 23.7K ETH worth of tokens, but rose in US Dollar terms to $110.9M from $87.8M. Liquidity is still split between the original osETH-ETH pool and the new, Boosted osETH-ETH pool - we still note that this is unlikely to be sustainable given the old pool has stopped receiving incentives, and capital is likely to eventually migrate away from it. The weight composition of the pools has tilted in favour of osETH in 65:35 weights, likely driven by a significantly longer withdrawal queue on Ethereum.

Liquidity in the osETH-rETH pool on Curve remained roughly flat at around 6.3K ETH worth of tokens, unchanged from last month. The pool remains well-balanced (~50/50).

osETH liquidity pools (Arbitrum)

The combined liquidity levels for osETH pools on Arbitrum now sit at around $0.8M vs $1.18 a month ago, having experienced outflows since the decision to stop incentives on Arbitrum was made in early September. The SLC will reconsider adding liquidity incentives to pools on Arbitrum once a clear strategy for expansion on L2s is in place.

osGNO liquidity pools

The osGNO-GNO liquidity pool on Balancer sits at around $3.12M in TVL, up on the month as a result of GNO price increase. This pool is not currently receiving SWISE incentives, being incentivized instead by the Gnosis ecosystem participants. The APY is nearing 10%.

SWISE liquidity pool

Following a withdrawal of 200 ETH of liquidity from a major LP, SWISE liquidity has considerably declined, triggering a proposal to deploy a new pool paired against osETH. The SLC has gradually stopped allocating incentives to the SWISE-ETH pool following the withdrawal and while the vote on the new pool and its deployment is ongoing.

Proposed budget for the next 4 weeks

| Week 39-42 (2025) | Inflows (Budget) |

|---|---|

| SWISE liquidity pool | 245,000 SWISE & 5.23 osETH |

| osETH liquidity pools (Mainnet) | 780,000 SWISE & 14.76 osETH |

| osETH liquidity pools (Arbitrum) | 0 SWISE |

| osGNO Liquidity pools | 0 SWISE |

| Team multisig compensation | 550,000 SWISE & 11.379 osETH |

| Total | 1,575,000 SWISE & 31.379 osETH |

osGNO liquidity pools

With a substantial reserve built up from the previous months, and the high level of incentives in the pool as of today, we are not requesting any tokens for the osGNO-GNO pool for the next 4 weeks.

SWISE liquidity pool

The aim is to establish deep liquidity for SWISE - at least as deep as before - with the initial allocation of 245K SWISE & 5.23 osETH per month for the new osETH-SWISE pool when it launches.

osETH liquidity pools Mainnet

The current liquidity depth is strong vs the overall TVL of StakeWise V3 and should be maintained. The expected cost for doing so is around 780,000 SWISE & 14.76 osETH per month.

osETH liquidity pools Arbitrum

After an analysis of osETH usage on Arbitrum it became clear that the majority of activity is centered around providing liquidity for osETH instead of holding the asset in the wallet for staking. Since the team has not expressed immediate plans to expand osETH usage in the Arbitrum ecosystem in the near future, it was decided to halt the incentives to the pool on Arbitrum in order to redirect this expenditure to more immediate needs, e.g. creating deeper SWISE liquidity. The SLC will continue monitoring the situation, and will recommend restoring incentives if/when there is a concrete expansion plan for osETH in place.